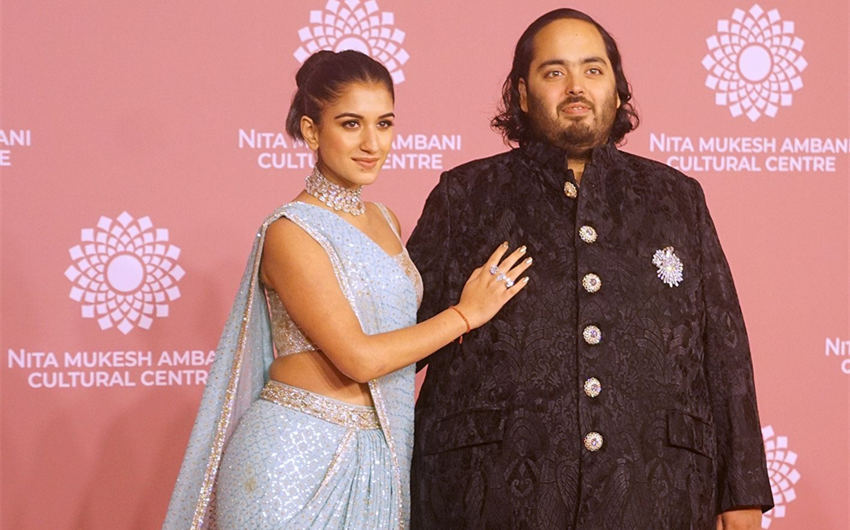

Net Worth of Anant Ambani: Estimates, Who He Is, and a Simple Breakdown

If you’ve searched the net worth of Anant Ambani, you’ve likely seen numbers that don’t even look like they belong in the same conversation. That happens because “net worth” gets calculated differently depending on whether the source is counting only what’s clearly tied to him today or also assigning him a share of wider Ambani family business wealth. Here’s the clean version: who he is, what the estimates usually look like, and what’s actually behind those figures.

Who Is Anant Ambani?

Anant Ambani is the youngest son of Mukesh Ambani, the chairman of Reliance Industries Limited (RIL). Reliance is one of India’s most powerful conglomerates, with large interests spanning energy, retail, digital services, and emerging growth areas. As Reliance pushes further into future-facing businesses, Anant has become more visible within the group and is widely seen as part of the next generation of long-term leadership.

Because he belongs to a family that controls a massive corporate empire, his financial profile is often discussed in a different way than a typical celebrity or executive. A lot of what you’ll read is shaped by how people interpret “family wealth” versus “personal wealth.”

Estimated Net Worth of Anant Ambani

There’s no single universally agreed number, but most estimates fall into two broad ranges based on what the source is really measuring.

Conservative estimates (more document-led):

Many discussions place his net worth in the hundreds of millions of dollars range (or a few thousand crore INR). These estimates tend to be anchored to what can be more clearly tied to him, such as disclosed equity holdings and other reasonably attributable assets.

High estimates (wealth attribution style):

Some wealth studies and media summaries have attributed figures as high as around ₹3.59 lakh crore to Anant Ambani (sometimes presented as an individual number, sometimes discussed alongside his brother). In most cases, these should be read as a slice of broader Ambani family-linked business value being assigned to him, not a simple “personally owned and fully itemized” balance sheet.

If you’re trying to make sense of those two ranges, here’s the simplest truth: smaller figures usually reflect what is easier to verify; larger figures often reflect what’s attributed to him through family-linked control and expected long-term wealth transfer.

Net Worth Breakdown: What’s Actually Behind the Numbers

To understand why net worth estimates can vary so much, it helps to look at the components most commonly used to build them.

1) Shares and equity value

This is the backbone of almost every serious wealth estimate. Equity stakes in large businesses—especially publicly listed companies—are the easiest to value because markets set a price every day. Even when ownership structures are complex, equity is still the starting point for most calculations.

This is also why net worth numbers fluctuate so often. When the share price moves, the value of the underlying stake moves with it, sometimes by a lot in a short period of time.

2) Executive roles and compensation

Leadership roles can add wealth through salary, bonuses, and long-term incentives. Over time, that can become meaningful. Still, for people connected to giant promoter-led companies, compensation usually isn’t the main driver of the biggest net worth headlines. The real weight tends to sit in ownership value rather than annual income.

3) Family-linked promoter wealth and control

This is the part that often creates the “huge” estimates. Reliance’s promoter and promoter-group ownership is held through a layered structure involving multiple entities and family-linked holdings. When wealth lists publish very large numbers for an individual heir, they’re often assuming that a share of this broader family-linked business value effectively belongs to that person—or will in practical terms as leadership and ownership evolve.

This is why some estimates jump dramatically. The moment you start assigning a portion of a multi-trillion-rupee empire’s promoter-linked value to an individual, the number stops looking like a normal “personal net worth” and starts looking like a measure of family economic power attributed to one person.

4) Future inheritance expectations

Many high-end estimates quietly price in the future—what someone may control later, not just what they personally own right now. That doesn’t mean those projections are impossible, but it does mean the figure is often closer to “expected future wealth” than “present personal net worth.”

5) Lifestyle assets (often mentioned, rarely decisive)

Homes, luxury vehicles, and other high-profile assets get a lot of attention online, but they usually aren’t the reason net worth figures reach the largest levels. They can be expensive, but they don’t explain lakh-crore claims. Those kinds of numbers only happen when business equity and family-linked value are doing most of the heavy lifting.

Featured Image Source: https://www.vanityfair.com/style/story/anant-ambani-radhika-merchant-wedding?srsltid=AfmBOoo1QVhdw1vdrTY1ZOUUcGNeKELKQ13uBZdbcW4sunQo3G2M0moR